in collaboration with

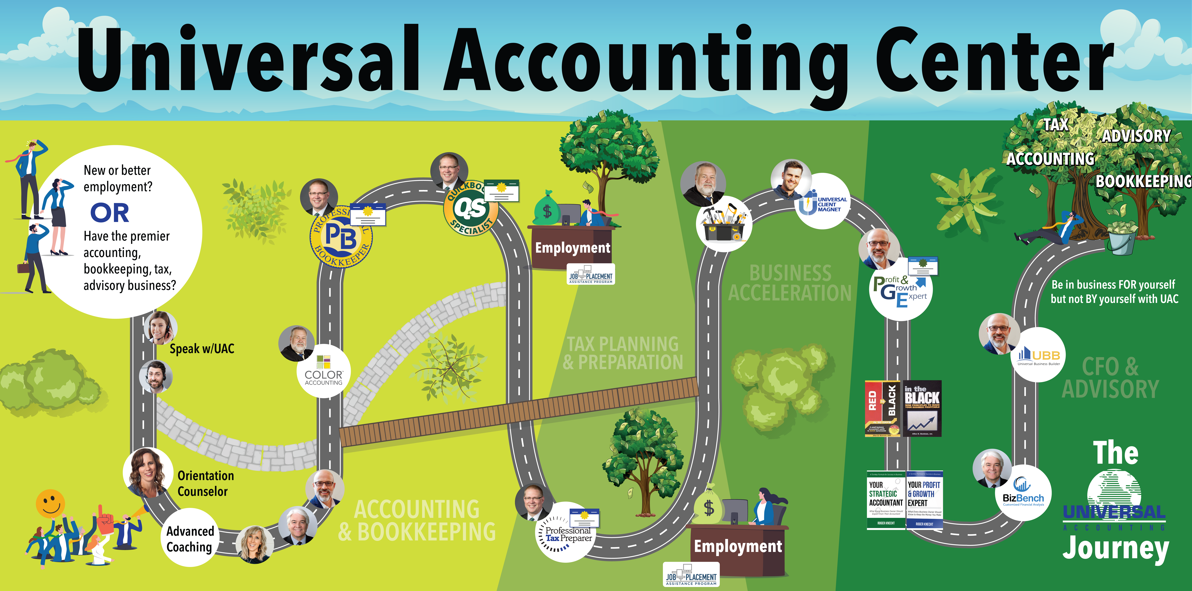

Build The Premier

Accounting Firm

Not only can you get certified in 4-6 weeks online, but we will help you hit your income & career goals!

Get the skills, certifications, and confidence to offer tax preparation services with Universal Accounting Center as a Professional Bookkeeper (PB), Professional Tax Preparer (PTP) and Enrolled Agent (EA)

in collaboration with

Learn the strategy and receive the support to offer aggressive tax planning and advisory services with Mark Kholer (Lawyer & CPA) and become a certified Main Street Tax Pro.

Meet The Experts

Guiding you through effective procedures and methods

Roger Knecht

Universal Accounting President

Roger Knecht

is president of Universal Accounting Center,

a post-secondary school for accounting professionals. With over 20 years of marketing, sales, HR & operations experience, Roger Knecht has helped thousands of business owners work ON their businesses to increase revenue, improve profits and build value. His strong work ethic and collaborative style delivers reliable, high-quality results for business owners.

Roger’s podcast, Building the Premier Accounting Firm, keeps accounting professionals on the cutting edge of the industry offering quality bookkeeping, accounting and tax services. He hosts discussions with some of the accounting world’s best minds and shares actionable insights for firms.

Roger is the author of “Your Strategic Accountant” and “Your Profit & Growth Expert”, each written to help business owners understand what they can expect from the accounting profession.

Universal Accounting provides accounting professionals with the training, certifications, coaching, and support they need to become Profit and Growth Experts for their clients.

If you want to have the premier accounting firm in your area contact Roger and his team at 801-265-3777 or visit them online at www.universalaccounting.com

Roger’s podcast, Building the Premier Accounting Firm, keeps accounting professionals on the cutting edge of the industry offering quality bookkeeping, accounting and tax services. He hosts discussions with some of the accounting world’s best minds and shares actionable insights for firms.

Roger is the author of “Your Strategic Accountant” and “Your Profit & Growth Expert”, each written to help business owners understand what they can expect from the accounting profession.

Universal Accounting provides accounting professionals with the training, certifications, coaching, and support they need to become Profit and Growth Experts for their clients.

If you want to have the premier accounting firm in your area contact Roger and his team at 801-265-3777 or visit them online at www.universalaccounting.com

- Phone:tel:+18015067463

- Email:rknecht@universalaccounting.com

Michael Rosedale

CPA, Training Instructor

Martha Shedden

President and Co-Founder of NARSSA

Train your staff to help you offer quality accounting services confidently and consistently. Whether they are new employees who need to be certified or existing staff who have proven their loyalty and are ready for more, this is the training they need.

In addition to training, certification, and support, you save your time having to do it all. Speak with our team to see what’s available and how we can help you.

Fill up the form to receive the

TRAINING INFORMATION

At Universal Accounting,

Our Focus is on You

Most other companies just want you to sign-up and pay for their course. You get certified, and that's it.

At Universal Accounting, we realize that's not what you want. You want to earn more money, make your own hours, and create a better life and career for yourself.

We can get you there because our program does the following:

Step 1 – Get You the Clients You Deserve

Step 2 – Offer Quality Accounting Services

Step 3 – Work Efficiently & Profitably

Complete the form NOW to learn more!

Consider all the benefits of taking this

Accounting course

- Convenient, at-home learning through an all-online course

- Get certified in just 2-4 weeks

- Earn $100+ an hour

- Work whenever and however you want

- Work from home, full-time or part-time

- Financing available (and we help you get clients. Just 1 client can pay for the whole class)

- Assigned individual academic & marketing coaches

- Job placement assistance

- Be in demand for your skills, set yourself apart from non-certified competitor

- Marketing & client acquisition assistance

- Continuing Professional Education, CPE, credits available

Build the Premier Bookkeeping, Accounting & Tax Business with trained staff and offer quality services

On 60 Minutes Anderson Cooper unveiled a challenge facing the Social Security system: widespread overpayments in Social Security benefits, and the subsequent clawbacks that shock unsuspecting recipients. This issue touches the lives of many Americans, from retirees to disabled workers and their dependents, emphasizing the crucial role of professional help in navigating these turbulent waters. Registered Social Security Analysts (RSSAs) are specially trained in this area.

How can the Social Security Administration’s mistake become your responsibility?

The segment illustrated these predicaments with the cases of the Swords, a Chicago couple confronted with a staggering $51,887 bill from the Social Security Administration (SSA), and Roy Farmer, who faced a claim for a debt from when he was just 11 years old. These stories demonstrate a larger, systemic problem within the SSA, where errors made by the agency become the burdens of citizens, who are often unable to shoulder this burden.

For the RSSAs, as well as the financial professionals, agents, advisors, and consumers who rely on their expertise, this report underscores the importance of the RSSA designation. RSSAs are equipped not only to assist clients in maximizing their lifetime Social Security benefits but also to serve as vigilant advocates in the face of SSA’s complex and error-prone system.

The situation highlighted in the "60 Minutes" segment clearly emphasizes the fiduciary responsibility to safeguard clients' interests.

The National Association of Registered Social Security Analysts, Ltd. (NARSSA) is committed to empowering our members with the tools and knowledge to support clients through these challenges. We believe that the expertise of RSSAs in crafting sophisticated claiming strategies is invaluable, especially as the demographic bulge of baby boomers moves into retirement.

In response to the challenges highlighted in the “60 Minutes” report, NARSSA will continue to advocate for policy changes that protect Social Security beneficiaries. We are dedicated to ongoing education for our members and to raising public awareness about the benefits of working with an RSSA.

Complete the form on this page to learn more and see how you can offer this valuable service to your clientele.