More than just a Tax Preparation Course

We focus on hitting your income & career goals.

If you are like our students, you want to make more money and have complete flexibility. We can get you there. Most courses just want you to sign up, but not us. First we get you certified, then our coaches work with you until you reach your income & career goals. Talk to us today!

Self-Paced Course

Do your training online anytime, anywhere on a schedule that fits your needs

Certified in 2-4 Weeks

Complete all 67 hours of video instruction in as little as 2-4 weeks

Financing Available

12, 18 or 24 month financing programs. Contact us for more info

Coaches & Support

We help you get certified, then we help you get a job or clients!

How We’re Different - We Focus on You

At Universal Accounting School, we understand the bottom-line of why you are looking for tax certification training. You are going through this training to make more money, to work your own hours, and to create a better lifestyle for yourself.

We're with you, and all the way!

That’s why from the very beginning, we give you a personalized coach! We want to hear what your goals are from the beginning. If you want to be certified in just 2 weeks, it’s possible. If you want to land a job, we can help you. If you want to run your own business and start getting clients or get more clients, we can do that together.

If you want to make $100,000+ a year, or just $1,000-$2,000 extra a month in part-time income, we can get you there.

How does our Tax Preparation Course work?

01

Includes all ebooks, worksheets & video instruction featuring experts in the field teaching you the most important tax preparation concepts in detail

02

As soon as you enroll, you’ll be assigned a skilled instructor who will serve as your personal guide throughout the tax preparation course (and after!) If at any point you have questions about any of the training, they are here for you to ensure your success and that you pass the upcoming tax preparation exam.

03

Our program was designed to fit your lifestyle. Access your online course anytime, anywhere. There are no due dates or deadlines to worry about.

04

After completing the course curriculum, you will prepare to take the Tax Certification Exam. The exam cost is included in your enrollment. Once you pass the exam, you will receive and be able to use the Professional Tax Preparer™ designation, recognized by employers worldwide as the gold standard in small business training.

05

For students interested in finding a job, this includes job placement assistance – assistance with interview preparation, resume writing, and job searches, etc. For students interested in starting or growing their business, this includes marketing assistance & getting new clients.

Universal Accounting®’s Professional Tax Preparer™ program will teach you how to complete individual and business returns so that you can find a new job or start your own tax business.

Employment Opportunity & Job Demand

How Important is Tax Preparer Certification?

“Accounting and finance professionals are in high demand… still, it’s the advanced certifications you earn that will help you secure the position and compensation you want. When you take the time to invest in professional development and certifications, it makes your resume stand out and sends a message to employers that you’re dedicated to your career and motivated to advance by enhancing your skills and knowledge.”

– Robert Half Finance & Accounting

As the saying goes, the only guarantees in life are death and taxes. Though this is often a lighthearted comment, the sentiment rings true. Taxes are not going anywhere, and everyone has to pay them. Because of this, your tax preparer certification is a worthwhile long-term investment. When you spend time taking tax preparation classes, you are not only gaining new skills and an understanding of the tax system, but you are also cementing your place in the job market for decades to come.

Some encouraging statistics:

- Nearly 80% of Americans were required to file taxes this year.

- Approximately 144 million individuals and 2.4 million corporations filed returns last year

- 82 million returns are prepared by paid professionals, only 23% of which are handled by franchises

- 32,000 tax preparation firms generate approximately 7.7 billion in revenue

- The majority of the firms that prepare tax returns are small, with less than 10 employees

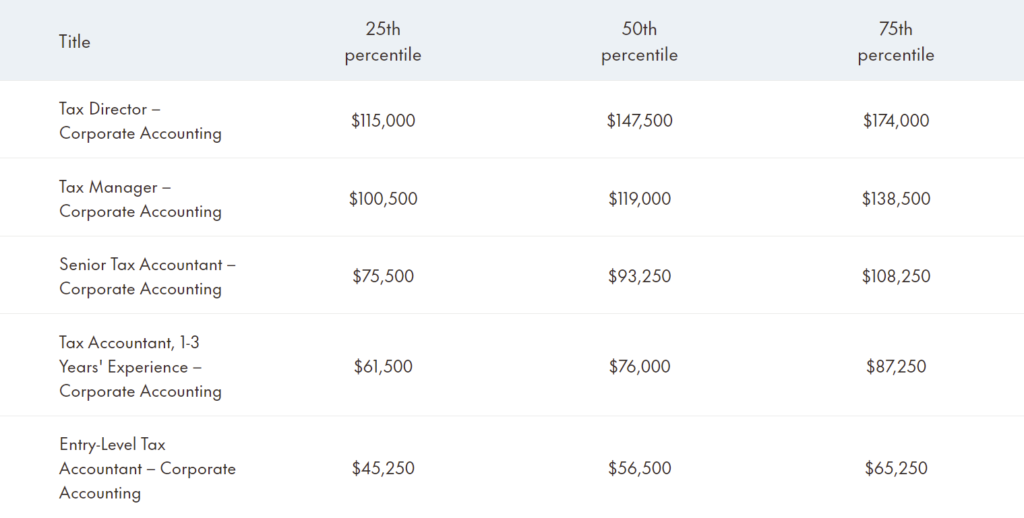

- Salary data included below. Click to zoom in

Testimonials From Our Students

“I began my journey with UAS at the beginning of 2021 by taking the Professional Tax Preparer program. The material was easy to get through because I already had some experience with preparing taxes, BSBA Accounting program with CPA focus. UAS went into great detail about the new tax laws that were implemented from 2018 (TCJA) and all the current changes that occurred during the pandemic. What I wasn’t expecting was a detailed turn-key system on how to run my tax business. There is an entire section that gives you marketing strategies that I can attest and say that they work! They really work!”

“I applied everything that was suggested and my first official tax year was a big success. It was so successful that I decided to take the Profit & Growth, Virtual Bookkeeper Roadmap, and Universal Business Builder program. PHENOMENAL! Everyone at UAS is invested in your success and celebrates your wins.”

“I’m exceedingly satisfied with the level of thought that went into these programs and how effective the strategies have been in my business. They say you’re in business for yourself but not by yourself. They really mean it! Now, you have to do the work in order for this to work. So if you’re afraid to roll up your sleeves and get to work then opening an accounting firm isn’t for you. Thank you UAS! Your program was more insightful than my BSBA."

Course Details

Course Overview

- 217 Video Lessons

- 62 Hours of Training

- Four Manuals With Exclusive Bonus Content

- Online Access, Anywhere, Anytime

- One-on-one Coaching & Support

- Real-world Tax Preparation Exercise

- Professional Tax Preparer™ designation

Your Enrollment Includes

- The opportunity to become certified as a Professional Tax Preparer and use the (PTP) designation upon qualification.

- An Orientation Counselor to help you get set up and through the training

- An Academic Coach to learn the material and help with real-world questions

- A Marketing Coach to help you apply our proven turnkey business plan to find and engage with your ideal clients as you start and build your business.

What You’ll Learn

As a certified Professional Tax Preparer™ you will have been trained and tested to provide the quality planning & preparation services expected from a tax preparer. Line by line, the Universal Accounting®’s Professional Tax Preparer™ program will teach you how to complete individual and business returns so that you can either prepare taxes on the side or start your own tax business full-time.

After the Program

Upon completion of the program, you’ll have the opportunity to speak with your assigned Marketing Coach and during our Marketing Implementation Session. This will be a one-on-one discussion to either (a) develop a plan for job placement to help you land your ideal job, or (b) develop your business plan and a clear marketing strategy to get you the clients you need.

Meet Your Coaches

Adam Syvoc

Your tutor Academic & Firm Coach

Professional Bookkeeper (PB) program

Adam works with Universal Accounting’s PB students regarding questions about the curriculum and real-world accounting situations. Adam is a graduate of Universal Accounting’s PB program himself, and also holds a bachelor’s degree in accounting from the University of Wisconsin-Milwaukee. In addition, Adam also uses his skills as a profit and growth expert to run his own accounting practice. He is also QuickBooks Certified and is working towards his Enrolled Agent (EA) designation to be able to help small businesses with accounting and tax.

Steve Eckman

Your tutor Academic & Firm Coach

Professional Tax Preparer (PTP)

Steve is a graduate of the University of Utah and was a medical laboratory entrepreneur for 13 years and an accountant, tax preparation and business growth expert for over 30 years, working with over 1100 small business owners and professionals in 11 states. He has been working with Universal Accounting for the past 7, and has grown his own successful bookkeeping, accounting and tax preparation business. Steve finds his real purpose in his family, has been married for over 45 years, and has 5 children, and 11 grandchildren. He enjoys working with his son, Trevor.

Bill Brough

MBA, EA Academic & Firm Coach

Professional Tax Preparer (PTP)

Bill came to the world of ledgers and tax returns by an unlikely route. He majored in music, and spent time as a songwriter in Los Angeles, even landing a spot on a production team for a Stevie Wonder spin-off called Writer’s Quarters West. To help make ends meet for his young family, Bill started a small business in 1988, part-time, while still keeping a foot in the music industry. But it quickly consumed all his time and energy, and he discovered that he actually enjoyed running a business, which required learning how to keep the books, which led to an MBA in finance and accounting. Eventually, Bill was hired by Universal Accounting Center in Salt Lake City to teach their unique bookkeeping and tax preparation courses to students from all over the country. He has been a lead writer and editor for Universal Accounting’s Professional Tax Preparer course. He also worked several seasons as a tax professional for H&R Block. Having worked several seasons as a tax professional for H&R Block, Bill currently runs his own thriving bookkeeping, accounting and tax preparation business.

Rick Howard

Structured Power Coaching

Professional Tax Preparer (PTP)

As a business coach, Rick has been instrumental in the development of our structured coaching program for students. He helped develop the Universal Practice Builder course, and worked directly with students when field testing the principles and practices for attracting and converting clients into new engagements. Rick has worked with accounting professionals throughout the United States and Canada on how to start and grow their own successful accounting practices.

Course Curriculum

Course Module 1

Establishing the Tax Foundation

Module 1 acts as an introduction to Tax Preparation. It will instruct you in the nuts and bolts of preparing the most common types of Tax Returns. Learning this material will not only give you a solid foundation in your understanding of the process of preparing business tax returns, but is also very helpful in aiding you when preparing individual tax returns.

Learn the entire process for determining income and adjustments to income, which will factor into the Adjusted Gross Income. You will cover all the information necessary to prepare Page one of Form 1040. — 10 Videos & Manual

- Getting Started

- Wages, Salaries, & Tips

- Schedule B – Interest/Dividend Income

- Schedule C-EZ and Schedule F

- Schedule D-Capitol Gain (or Loss)

- Retirement Income

- Schedule E – Income (or Loss) from Rental Property/Royalties/Partnerships etc.

- Occupational Adjustments

- Educational and Personal Adjustments

Course Module 2

Becoming the 1040 Expert

This module deals with the background information and forms that go into preparing Form 1040, Page 2. We also discuss all the adjustments that can be made to adjusted gross income, including credits that are allowed and different types of deductions and exemptions that can be taken against that adjusted gross income number. — 9 Videos & Manual

- Standard vs. Itemized deductions – Part A: Medical/Taxes

- Schedule A – Part B: Int/Char/Theft

- Schedule A – Part C: Job/Misc

- Calculating the Tax

- Non-Refundable Credits – Part A

- Other Taxes

- Payments & Refundable Credits

- Closing the Return

Course Module 3

Profitable Business Returns

In Module 3, we introduce you to the world of business organizations and their tax concerns. This module is a practical companion to Module 2, as it gives you experience in completing each of the schedules and forms common to business organizations. You will learn tax concepts in accounting, elements of business financial statements, and how to report gain and loss on dispositions of business property. — 8 Videos & Manual

- Business Entities

- Tax Elements in Accounting

- Financial Components

- Dispositions of Business Property

- Schedule C

- Form 1065

- Form 1120

- Form 1120S

Course Module 4

Building Your Successful Tax Practice

This module has been developed to give you a head start in creating and running your own tax preparation service. You will be given the turnkey process necessary to build a successful tax business. This includes proven marketing strategies, pricing, client interviewing for tax planning and preparation and much more. Universal Accounting Center will help you get your businesses running profitably in weeks, not months. The skills and strategies presented in Module 4 of the Professional Tax Preparer™ Program are the result of years of experience in running a profitable tax preparation business. You will find yourself light years ahead of the competition as you put these strategies into play. — 5 Videos & Manual

- Getting Started Right

- Effective marketing

- Comfortable Interviewing Techniques

- Profitable Fee Calculations

- Always the Expert Preparer

FAQ - Frequently Asked Questions

Professional Tax Preparer™ Certification, or PTP Certification, is Universal Accounting School’s unique program that affirms & validates the skills and abilities of an individual to perform tax preparation services for individuals & businesses.

- According to the IRS, any tax professional with an IRS Preparer Tax Identification Number (PTIN) is authorized to prepare federal tax returns.

- You need a PTIN number to prepare income taxes. If, however, you plan on starting your own tax preparation firm, you also will need an Electronic Filing Identification Number (EFIN) from the IRS. This gives your firm the ability to e-file tax returns, which is generally required of a firm that files 11 or more income tax returns.

- Any accountant or individual can call themselves a tax professional and offer services to help prepare federal tax returns, however the education and expertise of those individuals can vary widely. That is why certification from a reputable brand like Universal Accounting is not only recommended, but so necessary for most business opportunities. Certification clearly distinguishes to any prospective client that the certified individual is in fact a true tax professional with in-depth knowledge and experience into even the most unique tax situations.

- Changing legislation in the tax code and health care reform makes expertise in tax preparation & filing taxes more and more of a need. Employers and clients look for respected credentials when choosing to trust a tax professional.

- The professional designation of “PTP” that certifies their skills preparing individual and business returns

- Be in demand for your skills, set yourself apart from non-certified competitors

- Earn $100+ an hour

- Work whenever and however you want

- Reduce your own tax liability

- Work from home

- Work full-time or part-time

- Convenient, at-home learning through an all-online course

- The ability to do the program & get certified in weeks rather than months

- The ability to pay the tuition in full or take advantage of the available student loan options to finance

- The assigned individual coaches, an orientation counselor, academic coach (individual tutor), marketing coach

- The Continuing Professional Education, CPE, credits available – 67 hours. (Module 1: 24 hours, M2: 18, M3: 20, M4: 5)

- Job placement assistance

- Marketing & client acquisition assistance

- Yes, you can earn a total of 67 hours of CPE credits by taking our Professional Tax Preparation program. Each module you complete results in various credit hours earned.

- Module I – Establishing the Tax Foundation = 24 credit hours.

- Module II – Becoming the 1040 Expert = 18 credit hours

- Module III – Profitable Business Returns = 20 credit hours

- Module IV – Building Your Successful Tax Practice = 5 credit hours

- TOTAL = 67 hours

- To be admitted to one of Universals’ programs, the applicant must have a high school diploma or General Education Development (GED) certificate, and beyond the age of compulsory high school attendance, as prescribed by Utah law (see Rule 152-34-4(3) of the Utah Administrative Code).

- To register for one of Universal’s income tax preparation courses, it is suggested the student complete the Professional Bookkeeper™ program, or obtain a favorable review through interviewing with a Universal instructor or administrator.

- Universal’s Professional Bookkeeper™ and Professional Tax Preparer™ are designed to be completed in four-weeks. Other Universal courses vary in length. Please call the registrar’s office for specific information.

- Universal offers simple, 12, 18 or 24 month financing programs to those who qualify. For more information on financing qualifications and arrangements, please contact Universal’s Registrars office at 800-343-4827.

- Yes! We want to see you get the job you want.

- Graduates receiving one of Universal Accounting’s professional designations will be assigned a Personal Achievement Coach to assist them in their career pursuit. Universal’s job placement assistance program consists of resume preparation, resume placement strategies and successful interviewing techniques.

- Companies in the community often contact Universal for potential job candidates. While we may provide job attainment information; we cannot make guarantees for employment.

- As a student and or graduate of Universal Accounting’s Professional Tax Preparation program, a buyer is entitled to our Job Placement Assistance Program (PB, QS and PTP Programs), and may be assisted with:

- Resume Preparation

- Assistance via email in the review and development of a resume for the purpose of securing interviews

- Resume Placement Assistance

- Helping to identify possible employers and accounting related positions by following a weekly routine

- Interviewing Technique Review

- Role play advice and suggestions to improve the success of interviewing opportunities.

- Yes! We want to help you reach your goals, and the first step after you are certified is creating the plan to do so.

- Upon qualification, you become certified as a Professional Tax Preparer and are licensed to use the (PTP) designation. Your enrollment in the PTP Certification program extends even after you are qualified. As part of your enrollment and upon completion of the program you’ll have the opportunity to speak with your assigned business coach and have a Marketing Implementation Session. This will be a one-on-one discussion to develop your business plan and a clear marketing strategy to get you the clients you need. An assigned Marketing Coach will continue to be there to support & help you build a tax business. You’ll be assigned to them and a team of coaches to tutor and instruct you as needed and apply all of this in the real world for as many as 1 to 2 years. You’ll be following much of the training include in Module #4 of the PTP program, Building Your Successful Tax Practice – the turnkey process to start & build a successful tax business. This includes proven marketing strategies, pricing, client interviewing for tax planning and preparation and much more.

- Yes! From the beginning, we said we want to help you reach your income, career & lifestyle goals. Of course, you will need to put in the work to get the clients. But we will show you how and help you do so.

- The Professional Tax Preparer™ Program is designed to be a complete online course. And while it is self-directed (i.e. you can complete the course at your own pace), students will always have access to their instructors online.

- The course consists of 62 hours of tax training instruction. Our tax preparation courses include all necessary books and worksheets (over 600 pages of instruction and reference materials). This tax training course is engaging and entertaining. You have the flexibility to complete the courses on your own time, in a way that fits your life. The course is taught by experienced accounting workshop professionals who give practical advice on tax issues. Our tax instructors know what challenges you will face because they have been there themselves. They will provide you with real-world solutions to give you the edge in productivity and profitability.

- The Professional Tax Preparer (PTP) program is specifically designed to be completely online. While some people do prefer learning in an in-person atmosphere, and while it is possible to search for “tax classes near me” and find some viable options, we believe the benefits of an online class outweigh that of local in-person classes.

- Online courses are updated constantly with new tax legislation from around the country. Meanwhile, local tax preparation classes may have less frequently updated curriculums for non-local tax laws.

- Students receive significantly more access to resources when they go through their tax preparation training online. Our library of resources is vast. Plus, for any and all questions, teaching and program support are only an email or phone call away. Local options will likely be limited to one or two teachers, and their personal availability for questions or tutoring much less frequent.

- Online classes give students the flexibility and freedom to complete the curriculum at their own pace, fits well into already busy schedules, and allows students to continue participating in their life and career. Many of our students are already involved in the accounting or finance world and wish to continue working while they become certified tax preparers.

- Tax preparers prepare and file federal and state tax returns. Essentially, they review their client’s income and financial records such as W2s and dividend statements, then identify deductions and credits to determine the amount their client’s owe or will be refunded.

- As you can imagine, Tax Preparers must be familiar with various tax forms and schedules that the IRS and state tax boards issue. As such, tax preparers should be familiar with the requirements for filing taxes in the state’s in which they do business.

- The best way to know is to talk with us. If you’re interested in learning more about getting certified through our Professional Tax Preparer™ Certification program and exploring whether Universal Accounting’s at-home learning model is right for you, fill out the form on this page. A friendly and knowledgeable UAS Advisor would be happy to help you explore your options and uncover the right training solution and business plan to suit you.

With our help, you can be in business for yourself without being by yourself. Start our tax preparation course today!