Award Winning Online Bookkeeping Certification Course

We focus on hitting your income & career goals.

If you are like our students, you want to make more money and have complete flexibility. We can get you there. Most courses just want you to sign up, but not us. First we get you certified, then our coaches work with you until you reach your income & career goals. Talk to us today!

Self-Paced Course

Do your training online anytime, anywhere on a schedule that fits your needs

Certified in 2-4 Weeks

Complete all 67 hours of video instruction in as little as 2-4 weeks

Financing Available

12, 18 or 24 month financing programs. Contact us for more info

Coaches & Support

We help you get certified, then we help you get a job or clients!

Best online bookkeeping course

How does our Bookkeeping Course work?

01

Includes all ebooks, worksheets & video instruction featuring experts in the field teaching you the most important tax preparation concepts in detail

02

As soon as you enroll, you’ll be assigned a skilled instructor who will serve as your personal guide throughout the tax preparation course (and after!) If at any point you have questions about any of the training, they are here for you to ensure your success and that you pass the upcoming tax preparation exam.

03

Our program was designed to fit your lifestyle. Access your online course anytime, anywhere. There are no due dates or deadlines to worry about.

04

After completing the course curriculum, you will prepare to take the Tax Certification Exam. The exam cost is included in your enrollment. Once you pass the exam, you will receive and be able to use the Professional Tax Preparer™ designation, recognized by employers worldwide as the gold standard in small business training.

05

For students interested in finding a job, this includes job placement assistance – assistance with interview preparation, resume writing, and job searches, etc. For students interested in starting or growing their business, this includes marketing assistance & getting new clients.

Bookkeeping Professional Testimonials

Universal Accounting School - The Best School For Bookkeeping

How We’re Different - We Focus on You

At Universal Accounting School, we understand the bottom-line of why you are looking for bookkeeping certificate programs. You are going through this training to make more money, to work your own hours, and to create a better lifestyle for yourself.

We're with you, and all the way!

That’s why from the very beginning, we give you a personalized coach! We want to hear what your goals are from the beginning. If you want to be certified in just 2 weeks, it’s possible. If you want to land a job, we can help you. If you want to run your own business and start getting clients or get more clients, we can do that together.

If you want to make $100,000+ a year, or just $1,000-$2,000 extra a month in part-time income, we can get you there.

How does our Bookkeeping Course work?

01

Includes all ebooks, worksheets & video instruction featuring experts in the field teaching you the most important tax preparation concepts in detail

02

As soon as you enroll, you’ll be assigned a skilled instructor who will serve as your personal guide throughout the tax preparation course (and after!) If at any point you have questions about any of the training, they are here for you to ensure your success and that you pass the upcoming tax preparation exam.

03

Our program was designed to fit your lifestyle. Access your online course anytime, anywhere. There are no due dates or deadlines to worry about.

04

After completing the course curriculum, you will prepare to take the Tax Certification Exam. The exam cost is included in your enrollment. Once you pass the exam, you will receive and be able to use the Professional Tax Preparer™ designation, recognized by employers worldwide as the gold standard in small business training.

05

For students interested in finding a job, this includes job placement assistance – assistance with interview preparation, resume writing, and job searches, etc. For students interested in starting or growing their business, this includes marketing assistance & getting new clients.

How does our Bookkeeping Course work?

01

Includes all ebooks, worksheets & video instruction featuring experts in the field teaching you the most important tax preparation concepts in detail

02

As soon as you enroll, you’ll be assigned a skilled instructor who will serve as your personal guide throughout the tax preparation course (and after!) If at any point you have questions about any of the training, they are here for you to ensure your success and that you pass the upcoming tax preparation exam.

03

Our program was designed to fit your lifestyle. Access your online course anytime, anywhere. There are no due dates or deadlines to worry about.

04

After completing the course curriculum, you will prepare to take the Tax Certification Exam. The exam cost is included in your enrollment. Once you pass the exam, you will receive and be able to use the Professional Tax Preparer™ designation, recognized by employers worldwide as the gold standard in small business training.

05

For students interested in finding a job, this includes job placement assistance – assistance with interview preparation, resume writing, and job searches, etc. For students interested in starting or growing their business, this includes marketing assistance & getting new clients.

The Professional Bookkeeper™ program by Universal Accounting® will teach you the day-to-day practical application of the accounting process in small to mid-sized businesses.

Employment Opportunity & Job Demand

How Important is Bookkeeping Certification?

“A survey by HR.com recently posted that, of the companies participating, 100 percent of respondents agreed that industry certifications are preferred during the hiring process, in both new hire and internal employee placement scenarios. Certifications provide status to those who have proven their knowledge and give employers a benchmark standard for measuring employee candidates.”

– Robert Half Finance & Accounting

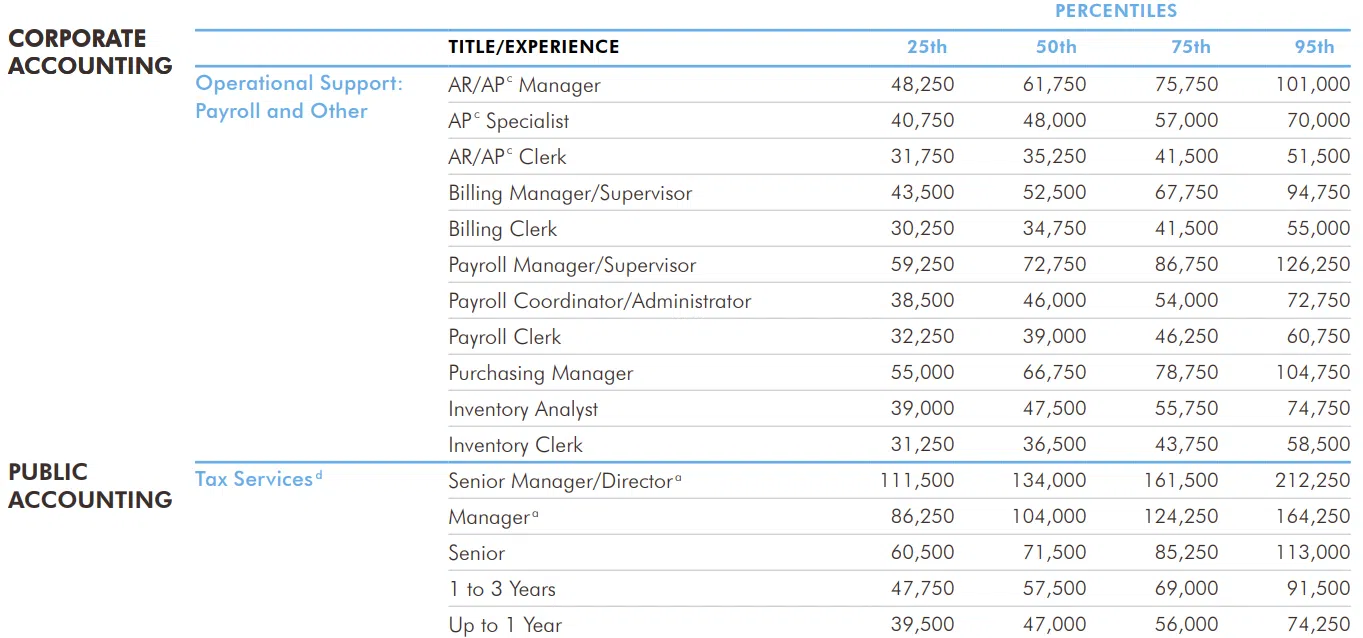

Crucial to every business is proper bookkeeping & accounting. In fact, the law requires it. Because of this, your bookkeeper certification is a worthwhile long-term investment. When you spend time taking the best online bookkeeping certification classes, you are not only gaining new skills and an understanding of the accounting system, but you are also cementing your place in the job market for decades to come. With your accounting skills and Bookkeeping Certification online, you’ll gain the knowledge to launch and develop a career that potentially pays you higher earnings. Consider the following chart, showcasing the average salaries of various positions in corporate bookkeeping & public accounting by their skill level (percentile).

Book Keeping Class Reviews

Testimonials From Our Students

“I took your course…as a newly divorced stay at home Mom of two very small children. While I did very well in the class, it was your marketing methods that allowed me to build my business successfully. I have clients all over Salt Lake City who are always amazed at what I can do vs what their previous bookkeepers have done for them. My family is supported solely on my income and I make a very good wage doing it. I own a home, drive a nice car, and have been home every afternoon when my kids walk in from school... I am living proof this works and it works well.” – Alecia Gale

“You should go to UAC because it is the best school out there to prepare you to become a professional bookkeeper. I checked out four other schools to get a certification and bottom-line all they are doing is preparing you for a test. UAC wasn’t. It was really about giving you case studies and teaching you how to become a bookkeeper. ” – Pam Hafer

I finished the course in about a month and officially launched my business at the beginning of the year. Within a week I was able to get my first client and... have not had a single client leave since. I am now up to 16 monthly clients with several more starting soon... My business is to a point where I have had to turn down some work, am about to sign a lease for a small office, and am looking for my first employee... I can definitely say that taking these courses enabled me to make all this happen.” – Matt Remuzzi

“I knew I needed help marketing my business from the moment I first thought about starting one. I was an accountant, not a marketing specialist... What I needed was someone to take me by the hand and lead me step-by-step through the entire marketing process… With Rick helping me, my networking experience has been nothing short of a miracle... I have discovered that it is not how professional you sound, but how sincere you are. There is a wealth of people in the business world that want to help you succeed…I no longer feel like a meek little office mouse. I feel enormous pride when I tell people that I am a profit and growth expert who owns a local business. My confidence in myself and in my skills has grown so much. If you do what your coach asks you to do, you will succeed.” – Jeanenne Leven

Course Details

Course Overview

- 81 Video Lessons

- Four Manuals With Exclusive Bonus Content

- Clock Hours: 60

- Online Access, Anywhere, Anytime

- Related Coaching & Support

- The Opportunity to Certify Your Skills

Your Enrollment Includes

- The opportunity to become certified as a Professional Bookkeeper and use the (PB) designation upon qualification

- An Orientation Counselor to help you get set up and through the training

- An Academic Coach to learn the material and help with real-world questions

- A Marketing Coach to help you apply our proven turnkey business plan to find and engage with your ideal clients as you start and build your business.

What You’ll Learn

The Professional Bookkeeper™ Certification Program was created to meet the high industry demand for qualified small business bookkeeping and accounting professionals. Completion of this program is your first step to accelerate your accounting and bookkeeping career. The Professional Bookkeeper™ designation is representative of a person proficient in the day-to-day practical application of the accounting process in small to mid-sized businesses. It demonstrates the accountant’s expertise and commitment to providing quality service for their employer or client. If you’re looking to become a bookkeeping professional who specializes in small to mid-sized businesses, or you’re interested in earning the credentials it takes to advance in your current career, you owe it to yourself to check out Professional certified bookkeeper Program.

After the Program

Upon completion of the program, you’ll have the opportunity to speak with your assigned Marketing Coach and during our Marketing Implementation Session. This will be a one-on-one discussion to either (a) develop a plan for job placement to help you land your ideal job, or (b) develop your business plan and a clear marketing strategy to get you the clients you need.

Advanced Bookkeeping Course Coaches

Meet Your Coaches

Allen Bostrom, CPA

Your tutor Academic & Firm Coach

Professional Bookkeeper (PB) program

Allen was the President and CEO of Universal Accounting from 1979 to 2014, when he was given the opportunity to expand his interest in helping accountants become better business consultants, and a stronger support for their employers and small business clients. Since that time, he has trained tens of thousands of accountants, bookkeepers, and tax preparers in practice and client management techniques and strategies.

Adam Syvock

Academic Coach

Adam works with students regarding questions about curriculum and real-world accounting situations. Adam is a graduate of Universal Accounting’s PB program himself, and also holds a bachelor’s degree in accounting from the University of Wisconsin-Milwaukee. In addition, Adam also uses his skills as a profit and growth expert to run his own accounting practice. He is also QuickBooks Certified and is working towards his Enrolled Agent (EA) designation.

We focus on hitting your income & career goals.

Course Curriculum

Course Module 1

Accounting Made Easy

Master the tools, procedures, and underlying principles that make up the bookkeeping processes of all businesses. Understand the core building blocks of Accounting and Bookkeeping. — 9 Videos & Manual.

Module 1 of the Professional Bookkeeper™ program teaches you the fundamentals of Bookkeeping. Through our hands-on teaching method, you will learn by doing, which ensures that the skills you gain stick with you. As you complete the practice sets in the Professional Bookkeeper™ course, you’ll become familiar with the processes involved in day-to-day Accounting and Bookkeeping tasks. They’ll become second nature to you, enabling you to focus on higher-level responsibilities.

Course Module 2

Practical Small Business Applications

Apply your understanding of the core accounting principles to specific industries. You will learn to set up books from scratch, do payroll like a seasoned pro, and much more. — 6 Videos & Manual.

Module 2 teaches you how to apply the basic principles from Module 1 to specific industries. You will learn the day-to-day procedures used by businesses each month to record and tabulate their finances. You will also learn to set up books from scratch, preparing all of the ledgers and journals needed to do full service Accounting for your paying clients.

Course Module 3

Advancing your “Account-Ability”

Sure ways to set up complete bookkeeping systems and manage the books for a variety of more sophisticated industries. — 9 Videos & Manual.

Module 3 will help you set up a complete bookkeeping system in order to manage clients from a variety of sophisticated industries for your business. This module will provide training on the more sophisticated issues associated with creating a set of books from scratch, auditing the results internally, and closing out the books at the end of the year.

Course Module 4

Building a Successful Accounting Service

Learn the steps to finding paying clients. Start and Grow an accounting practice following a proven program tested and perfected since 1979. — 7 Videos & Manual.

Module 4 is designed to assist you in successfully creating your own professional in-home, or office-based bookkeeping and accounting service. It gives you our turnkey process to start and build a successful accounting business. This includes proven marketing strategies, pricing, client interviewing for budgeting & forecasting and much more.

Follow-up Support

For 12 to 24 months you will be assigned a specific coach who can help instruct and tutor you within the training and with real-world applications after you complete the program.

Two Additional Practice Sets

Practice makes perfect. The modules already contain practice sets for nine different businesses. With your purchase you’ll receive two more practice sets, giving you eleven in all. This will give you even more confidence and experience in various industries and the opportunity to work with additional types of clients.

Bookkeeper Training Questions

FAQ - Frequently Asked Questions

- The Professional Bookkeeper™ designation is representative of a person proficient in the day-to-day practical application of the accounting process in small to mid-sized businesses. It demonstrates the accountant’s expertise and commitment to providing quality service for their employer or client.

- Upon completion of our bookkeeping program & passing the Professional Bookkeeper exam, you earn the designation of Professional Bookkeeper™, a nationally recognized certification regarded by employers as the gold standard in accounting training for small businesses.

- The Professional Bookkeeper™ (PB) Program itself is the premier training course in small-business accounting. Since 1979, Universal Accounting Center has specialized in small-business accounting, honing our training materials to become the most complete and competitive on the market.

- Completion of the Professional Bookkeeper program may also qualify for as many as 60 Continuing Professional Education (CPE) credits depending on the state or association you are a member of.

- According to the U.S. Bureau of Labor Statistics, if you intend to pursue a career as a bookkeeper or bookkeeping professional, you are required to hold at least a high school diploma. Many employers, however, may prefer that you complete some postsecondary coursework or hold an associate degree in business, accounting, or a similar field. Although it isn’t required, some bookkeepers also take bookkeeping classes, pursue certifications, or earn bachelor’s degrees to increase their chances of employment and promotion.

- Any financial person or accountant can call themselves a professional bookkeeper and offer services to help businesses record and organize their finances, however the education and expertise of those individuals can vary widely. That is why certification from a reputable brand like Universal Accounting is not only recommended, but so necessary for most business opportunities. Certification clearly distinguishes to any prospective client that the certified individual is in fact a true bookkeeping professional with in-depth knowledge and experience into even the most unique accounting situations.

- Changing legislation in accounting practices and tax code makes expertise in bookkeeping more and more of a need. Employers and clients look for respected credentials when choosing to trust a bookkeeper.

- The professional designation of “PB” that certifies their skills in all aspects of bookkeeping & accounting practices for small to medium sized businesses

- Be in demand for your skills, set yourself apart from non-certified competitors

- Earn $100+ an hour

- Work whenever and however you want

- Reduce your own tax liability

- Work from home

- Work full-time or part-time

- Convenient, at-home learning through an all-online course

- The ability to do the program & get certified in weeks rather than months

- The ability to pay the tuition in full or take advantage of the available student loan options to finance

- The assigned individual coaches, an orientation counselor, academic coach (individual tutor), marketing coach

- The Continuing Professional Education, CPE, credits available – 60 hours. (Module 1: 24 hours, M2: 18, M3: 20, M4: 5)

- Job placement assistance

- Marketing & client acquisition assistance

- Yes, you can earn a total of 60 hours of CPE credits by taking our Professional Bookkeeping program. Each module you complete results in various credit hours earned.

- Module I – Accounting Made Easy

- Module II – Practical Small Business Applications

- Module III – Advancing your “Account-Ability”

- Module IV – Building Your Successful Accounting Practice

- TOTAL = 60 credit hours

- To be admitted to one of Universals’ programs, the applicant must have a high school diploma or General Education Development (GED) certificate, and beyond the age of compulsory high school attendance, as prescribed by Utah law (see Rule 152-34-4(3) of the Utah Administrative Code).

- To register for one of Universal’s income tax preparation courses, it is suggested the student complete the Professional Bookkeeper™ program, or obtain a favorable review through interviewing with a Universal instructor or administrator.

- Universal’s Professional Bookkeeper™ and Professional Tax Preparer™ are designed to be completed in four-weeks. Other Universal courses vary in length. Please call the registrar’s office for specific information.

- Universal offers simple, 12, 18 or 24 month financing programs to those who qualify. For more information on financing qualifications and arrangements, please contact Universal’s Registrars office at 800-343-4827.

- Upon registration, students are provided with workbooks and other classroom materials necessary to complete the course. The appropriate distance-learning instructional videos will be provided as well.

- Yes! We want to see you get the job you want.

- Graduates receiving one of Universal Accounting’s professional designations will be assigned a Personal Achievement Coach to assist them in their career pursuit. Universal’s job placement assistance program consists of resume preparation, resume placement strategies and successful interviewing techniques.

- Companies in the community often contact Universal for potential job candidates. While we may provide job attainment information; we cannot make guarantees for employment.

- As a student and or graduate of Universal Accounting’s Professional Bookkeeper program, a buyer is entitled to our Job Placement Assistance Program (PB, QS and PTP Programs), and may be assisted with:

- Resume Preparation

- Assistance via email in the review and development of a resume for the purpose of securing interviews

- Resume Placement Assistance

- Helping to identify possible employers and accounting related positions by following a weekly routine

- Interviewing Technique Review

- Role play advice and suggestions to improve the success of interviewing opportunities.

- Yes! We want to help you reach your goals, and the first step after you are certified is creating the plan to do so.

- Upon qualification, you become certified as a Professional Bookkeeper and are licensed to use the (PB) designation. Your enrollment in the PB Certification program extends even after you are qualified. As part of your enrollment and upon completion of the program you’ll have the opportunity to speak with your assigned business coach and have a Marketing Implementation Session. This will be a one-on-one discussion to develop your business plan and a clear marketing strategy to get you the clients you need. An assigned Marketing Coach will continue to be there to support & help you build a tax business. You’ll be assigned to them and a team of coaches to tutor and instruct you as needed and apply all of this in the real world for as many as 1 to 2 years. You’ll be following much of the training include in Module #4 of the PB program, Building Your Successful Accounting Practice – the turnkey process to start & build a successful tax business. This includes proven marketing strategies, pricing, client interviewing for tax planning and preparation and much more.

- Yes! From the beginning, we said we want to help you reach your income, career & lifestyle goals. Of course, you will need to put in the work to get the clients. But we will show you how and help you do so.

- The Professional Bookkeeper™ Program is designed to be a complete online course. And while it is self-directed (i.e. you can complete the course at your own pace), students will always have access to their instructors online.

- The course consists of 60 hours of tax training instruction. Our bookkeeping courses include all necessary books and worksheets (over 600 pages of instruction and reference materials). This bookkeeping course is engaging and entertaining. You have the flexibility to complete the courses on your own time, from anywhere and in a way that fits your life. Even though you may be training from the comfort of home, you are far from on your own. You’ll have access to the support of knowledgeable bookkeeping accounting coaches and mentors who have their own successful accounting firms along with other experienced pb accounting professionals throughout your course and beyond. Our accounting instructors know what challenges you will face because they have been there themselves. They will provide you with real-world solutions to give you the edge in productivity and profitability.

- The Professional Bookkeeper (PB) program is specifically designed to be completely online. While some people do prefer learning in an in-person atmosphere, and while it is possible to search for “bookkeeping classes near me” and find some viable options, we believe the benefits of an online class outweigh that of local in-person classes.

- Online courses are updated constantly with new bookkeeping legislation from around the country. Meanwhile, local bookkeeping classes may have less frequently updated curriculums for non-local finance laws.

- Students receive significantly more access to resources when they go through their bookkeeping training online. Our library of resources is vast. Plus, for any and all questions, teaching and program support are only an email or phone call away. Local options will likely be limited to one or two teachers, and their personal availability for questions or tutoring much less frequent.

- Online classes give students the flexibility and freedom to complete the curriculum at their own pace, fits well into already busy schedules, and allows students to continue participating in their life and career. Many of our students are already involved in the accounting or finance world and wish to continue working while they become certified bookkeepers.

- A bookkeeper is a professional who helps businesses and other organizations keep their finances in order. They manage general accounting ledgers, record journal entries (transactions), and generate financial statements.

- Typically bookkeepers are responsible for preparing four key financial statements:

- Income statement (also called a profit & loss statement), which shows your revenue and your expenses over a specified time period

- Balance sheet, which is just a snapshot of your financial position at one point in time

- Cash flow statement, which is a record of the cash and cash-like equivalents entering and leaving your company

- Statement of changes in equity (also called a statement of retained earnings) which shows how your share of capital, reserves, and retained earnings have changed in a reporting period

- Some other important bookkeeping tasks that help your business run like a well-oiled machine:

- Manage accounts receivable and accounts payable (make sure you get paid on time, and pay your bills on time)

- Post debits and credits

- Collect and remit sales tax to the government

- Monitor debt levels and apply payment to any debt as it comes up for payment

- Record incoming cash and deposit at the bank

- Handle bank reconciliations every month

- Equip your CPA with accurate financial statements at tax time

- Maintain your annual budget

- Report on issues and variances when they pop up

- Process payroll

- They can also usually take care of some of the tax preparation so that your accountant has less to do (which is a good thing, because bookkeepers are less expensive than a CPA). But they won’t be able to help you with tax planning or handling your tax return.

- The best way to know is to talk with us. If you’re interested in learning more about getting certified through our Professional Bookkeeper™ Certification program and exploring whether Universal Accounting’s at-home learning model is right for you, fill out the form on this page. A friendly and knowledgeable UAS Advisor would be happy to help you explore your options and uncover the right training solution and business plan to suit you.

We focus on hitting your income & career goals.

With our help, you can be in business for yourself without being by yourself. Start our bookkeeping course today!