Earn CPE Credit by Taking the PTP Program

- Module I – Establishing the Tax Foundation = 24 credit hours

- Module II – Becoming the 1040 Expert = 18 credit hours

- Module III – Profitable Business Returns = 20 credit hours

- Module IV – Building Your Successful Tax Practice = 5 credit hours

- TOTAL = 67 hours

Tax preparation is a lucrative business. Consider that first-time preparers submit tax forms for 50 clients, charging an average of $150 each. They make, roughly, $7500 working the 45 days before April 15th, and that’s before they have had much time to build a solid clientele. For many people, this represents 3 months of salary. That’s an appealing career path for many individuals.

Whether you want to earn a significant amount of money on the side, start your own full-time tax practice, or complement your current accounting services with tax preparation, you can appreciate the value of comprehensive tax preparation training.

The Professional Tax Preparer Program

UAC’s Professional Tax Preparer (PTP) program will enable you to become proficient in the completion of individual and business returns. The PTP provides you with the following:

- 20 hours of valuable video instruction

- Hands-on training in completing full individual (1040) and business returns (1065, 1120, 1120S)

- Step-by-step instruction in becoming a sole practitioner

- One year of follow-up support from expert tax preparers

- The opportunity to earn valuable professional certification

The Value of Tax Training

In today’s world of complex tax laws and increasing tax fraud occurrences, taxpayers are looking for specialists with credentials. It affords clients peace of mind to know that the individual they’re working with is qualified and knowledgeable. It also affords the tax preparer peace of mind to know they’ve been properly trained. Universal recognizes the value of a professional designation and awards the Professional Tax Preparer certification to those who successfully pass the final exam with a score of 90% or more.

The program is comprised of the following 4 modules (Training Includes:):

Establishing the Tax Foundation — Course Module 1

Learn the entire process for determining income and adjustments to income, which will factor into the Adjusted Gross Income. You will cover all the information necessary to prepare Page one of Form 1040. — 10 Videos & Manual

- Getting Started

- Wages, Salaries, & Tips

- Schedule B – Interest/Dividend Income

- Schedule C-EZ and Schedule F

- Schedule D-Capitol Gain (or Loss)

- Retirement Income

- Schedule E – Income (or Loss) from Rental Property/Royalties/partnerships/SCorporations/Trusts

- Other Types of Income

- Occupational Adjustments

- Educational and Personal Adjustments

Becoming the 1040 Expert — Course Module 2

The module deals with the background information and forms that go into Form 1040, Page 2. We also discuss all the adjustments that can be made to adjusted gross income, including credits that are allowed and different types of deductions and exemptions that can be taken against that adjusted gross income number. — 9 Videos & Manual

- Standard vs. Itemized deductions – Part A: Medical/Taxes

- Schedule A – Part B: Int/Char/Theft

- Schedule A – Part C: Job/Misc.

- Calculating the Tax

- Non-Refundable Credits – Part A

- Non-Refundable Credits – Part B

- Other Taxes

- Payments & Refundable Credits

- Closing the Return

Profitable Business Returns — Course Module 3

In Module 3, we introduce you to the world of business organizations and their tax concerns. This module is a practical companion to Module 2, as it gives you experience in completing each of the schedules and forms common to business organizations. — 8 Videos & Manual

- Business Entities

- Tax Elements in Accounting

- Financial Components

- Dispositions of Business Property

- Schedule C

- Form 1065

- Form 1120

- Form 1120S

Building Your Successful Tax Practice — Course Module 4

This module has been developed to give you a head start in creating and running your own tax preparation service. You will find yourself light years ahead of the competition as you put these strategies into play. — 5 Videos & Manual

- Getting Started Right

- Effective marketing

- Comfortable Interviewing Techniques

- Profitable Fee Calculations

- Always the Expert Preparer

12 Months Follow-up Support

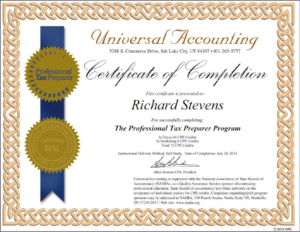

Get Certified as a Professional Tax Preparer™ Certificate of completion (final grade greater than 65%) Professional Tax Preparer™ designation (with 90% or better grade)

Customized Web Site (Free Promotional Offer)

With your enrollment, you can create a custom Web site for your business and host it for free for 6 months. Your Web site will become a valuable part of your marketing; in many cases, you may only need to refer prospective clients to your site and it will sell your services for you. See custom Universal Accounting® Websites

A Career In Accounting and Bookkeeping

For those interested in pursuing Accounting and Bookkeeping as a career, the Professional Bookkeeper™ (PB) Program prepares you to excel in these fields.

Learn More About the Professional Bookkeeper™ career track

If you are considering adding Accounting and Bookkeeping services to your business at some point, you get a tuition discount when you enroll in both programs as a bundle.