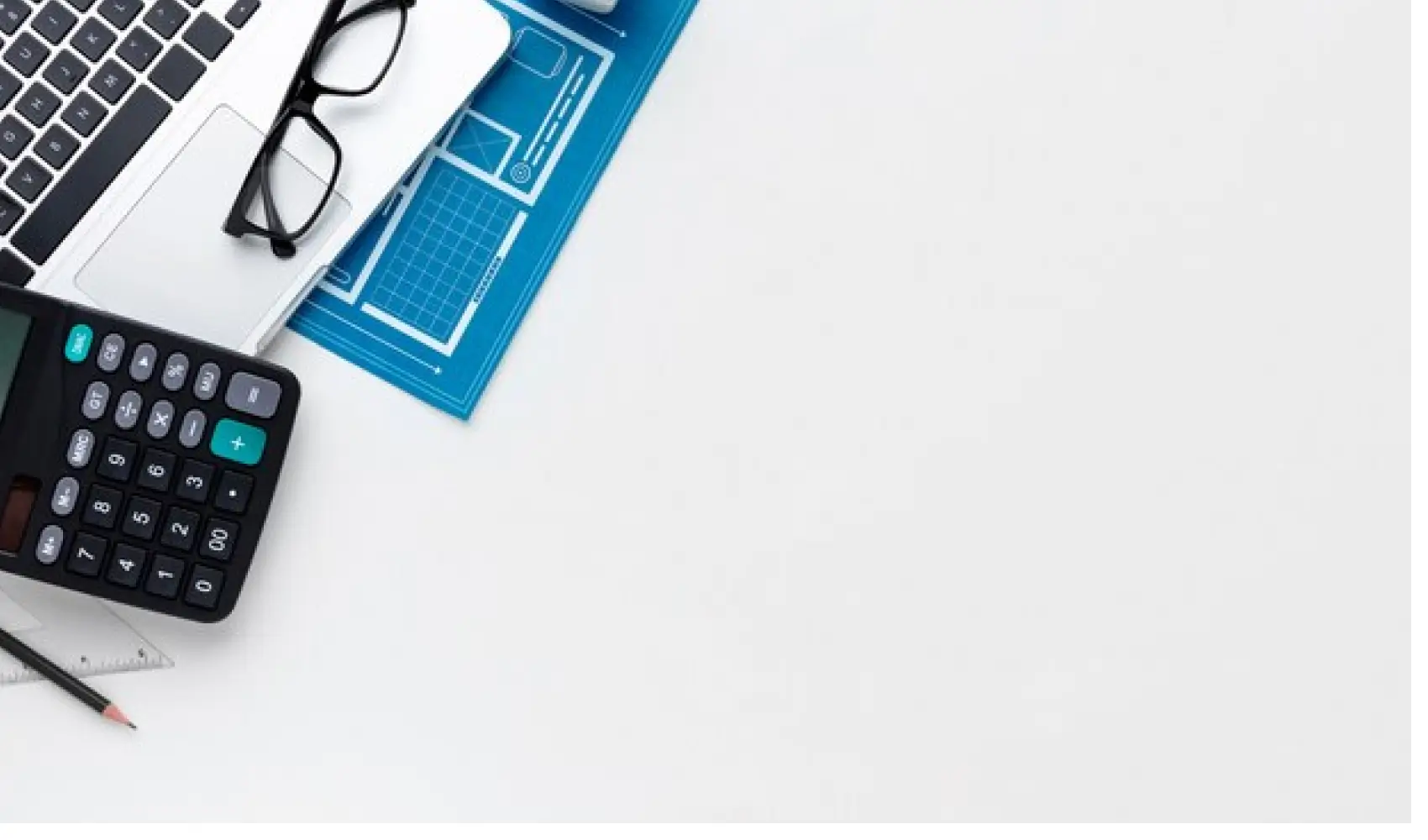

Is Write-Up Software For You? In recent weeks there has been a lot of interest in the area of accounting software, particularly write-up systems. Readers and course graduates are asking

Customer Relationship Management (CRM) has changed the face of online business. People using it for their businesses have doubled their sales. People are of the view that CRM software and

In the era of digital nomads and remote work, online bookkeeping jobs have become a viable option for finance professionals seeking flexibility and the opportunity to work from anywhere. Whether

As the complexities of the tax landscape continue to evolve, the demand for highly skilled tax professionals is steadily rising. For those aiming to elevate their tax preparation skills and

A Head to Head Comparison of Features QuickBooks Pro 2000 has some QuickBooks competition. For years, Intuit, the maker of QuickBooks, has been the name most small business owners have

QuickBooks, a versatile accounting software, is an invaluable asset for businesses of all sizes. Whether you’re a small business owner or an aspiring accountant, mastering QuickBooks can significantly enhance your

Are you looking for a career in the tax industry? Have you considered becoming an enrolled agent (EA)? An enrolled agent is a federally-authorized tax practitioner who has technical expertise

The IRS Annual Filing Season Program (AFSP) is a voluntary program designed to recognize tax preparers who have completed a certain level of tax education and have met the IRS's

QuickBooks Online is a popular accounting software used by small businesses and self-employed individuals. With its user-friendly interface and comprehensive features, it has become a go-to choice for managing finances.

Bookkeeping is an essential aspect of any business, big or small. It involves the record keeping, organizing, and managing of financial operations and information. Bookkeeping is crucial for expense tracking

How to See Failure as Opportunity and Turn Hardship into Success Every failure, obstacle or hardship is an opportunity in disguise. Success in many cases is failure turned inside out.

Attention: Outsourcing of Tax Returns is on the Decline... Opportunities for Local Professional Tax Preparers on the Rise Wanted -More Professional Tax Preparers. Over the last few years, many large

The success of marketing for a tax preparation business is defined by the planning and organizing of that process. Your marketing strategy is as effective as your marketing plan. With

Getting your business's accounting in order has many benefits. Not only does it help with bookkeeping and taxes, but it'll also bring peace of mind. Additionally, if you're someone who

The first few months after starting a bookkeeping business are critical. There's so much to get organized, from branding to your workflow and on to pricing strategies, it can feel