In today’s fast-paced business world, accurate financial records are essential for growth and sustainability. That’s where a bookkeeping business comes in. Whether you’re a small business owner overwhelmed by receipts or an aspiring bookkeeper looking to start your own company, understanding how a bookkeeping business works is the first step to success.

In this post, we’ll break down what a bookkeeping business is, how it operates, and why remote bookkeeping services are becoming increasingly popular. We’ll also explore the role of professional bookkeeping and how you can get started in this rewarding field.

What is a Bookkeeping Business?

A bookkeeping business is a service-based company that helps individuals and businesses manage their financial records. This includes tracking income and expenses, reconciling bank statements, generating reports, managing payroll, and preparing data for accountants or tax professionals.

Unlike accounting, which often involves interpreting financial data and strategic planning, bookkeeping focuses on the day-to-day financial transactions. It’s the foundation of financial clarity for any business, ensuring everything is organized, up-to-date, and compliant with laws and regulations.

Services Typically Offered by a Bookkeeping Business

- Recording daily financial transactions

- Managing accounts payable and receivable

- Bank and credit card reconciliation

- Payroll processing

- Generating financial statements (like Profit & Loss and Balance Sheets)

- Budgeting and cash flow monitoring

- Sales tax filing and reporting

- Preparing data for tax filing

Who Needs Bookkeeping Services?

You might think bookkeeping is only for large companies, but in reality, small businesses, startups, freelancers, and even nonprofits benefit from it. Many business owners either don’t have the time or knowledge to manage their books properly and mistakes can be costly.

That’s why outsourcing to a professional bookkeeping service or hiring a freelance bookkeeper has become so common. It saves time, reduces errors, and gives business owners peace of mind.

How Does a Bookkeeping Business Work?

A bookkeeping business can operate in several ways, depending on the services it offers, the size of its team, and its client base. Here’s a general look at how it works:

1. Client Onboarding

First, the bookkeeper meets with a new client to understand their needs. This involves reviewing current financial systems, software, transaction volume, and pain points. Then, a customized service plan is created.

2. Choosing the Right Tools

Most bookkeeping businesses use cloud-based accounting software like QuickBooks Online, Xero, or FreshBooks. These platforms make it easy to collaborate with clients and manage finances in real time.

3. Day-to-Day Operations

Once set up, the bookkeeper manages ongoing tasks such as:

- Recording transactions

- Sending invoices

- Paying bills

- Reconciling accounts

These tasks are usually done weekly or monthly, depending on the client’s needs.

4. Reporting and Review

Monthly or quarterly reports are shared with the client to show financial performance, spot trends, and help with decision-making.

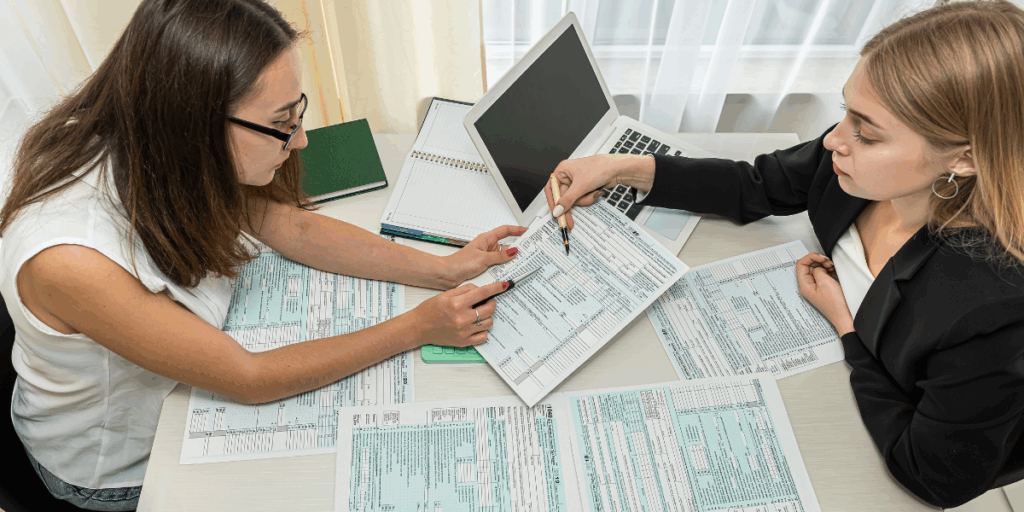

5. Collaboration with Accountants

During tax season, bookkeepers often work with the client’s accountant to ensure all financial data is accurate and ready for filing. A well-organized set of books makes tax time smoother and often more affordable.

The Rise of Remote Bookkeeping Services

One of the biggest changes in the industry is the shift to remote bookkeeping services. With cloud software and secure communication tools, there’s no longer a need to sit in an office or even meet clients in person.

Remote bookkeeping allows professionals to work from anywhere, giving them the freedom to run their business on their terms. It also means clients can access their books 24/7, collaborate with their bookkeeper in real time, and save money on in-house staff.

Benefits of Remote Bookkeeping Services

- Flexibility: Bookkeepers can serve clients across the country or even globally.

- Cost-Effective: Clients avoid the cost of hiring a full-time employee.

- Scalability: Services can easily grow as the business grows.

- Convenience: Both clients and bookkeepers enjoy the freedom to work when and where it’s best for them.

What Makes a Bookkeeping Business “Professional”?

Anyone can call themselves a bookkeeper, but professional bookkeeping involves more than just data entry. A professional bookkeeper understands accounting principles, uses best practices, and delivers reliable results that support business growth.

Professional bookkeepers often have certifications, ongoing training, and experience with a variety of clients. They’re also familiar with compliance requirements and know how to keep financial records secure and accurate.

At Universal Accounting School, you can become a professional bookkeeper through specialized training programs that teach you the real-world skills needed to succeed in the field. Whether you want to work for a company or start your own bookkeeping business, the right education can make all the difference.

Starting Your Own Bookkeeping Business

If you’re thinking about launching your own bookkeeping business, there’s never been a better time. The demand is high, and with the ability to offer remote bookkeeping services, your startup costs can be relatively low.

Steps to Get Started:

- Get Trained and Certified

Learn the fundamentals of bookkeeping and accounting. Enroll in a training program like those offered at Universal Accounting School. - Choose a Niche

Serving a specific industry (like restaurants, e-commerce, or contractors) can help you stand out and command higher fees. - Register Your Business

Choose a business name, register it legally, and get any necessary licenses or insurance. - Set Up Your Tech Stack

Choose bookkeeping software and communication tools that let you serve clients efficiently. - Start Marketing

Build a website, create social media profiles, and network online and in person to find your first clients. - Deliver Great Results

Focus on accuracy, consistency, and clear communication to build long-term relationships.

Why Bookkeeping is a Rewarding Career

A career in bookkeeping offers flexibility, job security, and the satisfaction of helping others succeed. It’s especially ideal for detail-oriented individuals who enjoy numbers and organization.

Plus, as businesses grow and financial regulations become more complex, the need for professional bookkeeping continues to rise. Whether you’re freelancing, running a full-scale business, or working for a company, you’ll always be in demand.

Conclusion

A bookkeeping business plays a vital role in helping businesses maintain financial health and make informed decisions. With the rise of remote bookkeeping services and the importance of professional bookkeeping, now is a great time to get involved in this field.

If you’re ready to start your own bookkeeping journey or want to grow your existing skills check out the training and certification programs at Universal Accounting School. With expert guidance and practical tools, you can build a business that gives you freedom, stability, and the chance to truly make an impact.