Debt can be tricky to navigate, especially if your business has been in thered and struggling to get into the black for quite some time. Thankfully, there are many ways to get your business out of debt and increase your long-term financial health as you do so. Below, Universal Accountingoffers seven ways to tackle your debts and get back on track with your finances.

1. Put Yourself in Control

Step one is to identify where you are in terms of debt. How much do you owe and to whom? Start by separatingyour business and personal accounts. Then, get your financial house in order. What are your net earnings? What’s left over after paying bills, rent or mortgage, credit cards, and other liabilities? How much money can you afford to put toward debt repayment every month?

2. Have an Effective Invoicing Process

Timely payments are essential to your success. That’s why upgrading your invoicing softwareis an important step in ensuring that your business gets paid on time. By investing in a quality invoicing system, you can save yourself the hassle of chasing down late payments and worrying about cash flow. In addition, a good invoicing system can help you keep track of your spending, budget more effectively, and make it easier to keep close track of your overall financial health.

How to Create a Budget for Your Business to Eliminate Debt 3. Create a Budget

One of the first steps in any debt-reduction plan is creating a budget. Think of it as a spending plan that includes what you need to spend and how much you can afford. Creating a budget helps show where your money goes every month and helps identify areas where you can cut back or save more money.

4. Reduce Expenses

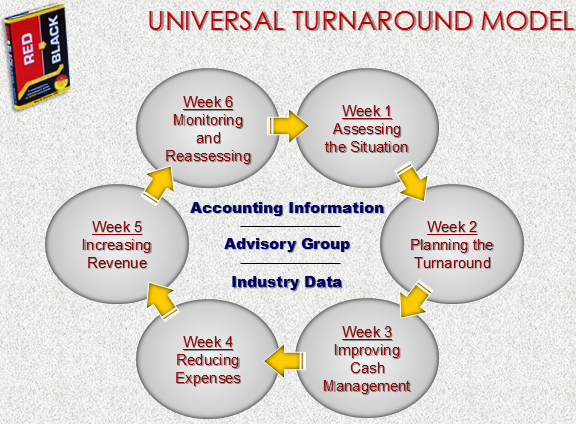

It’s common for small businesses to operate on a thin margin. But if your business is in constant survival mode with little room to breathe or plan, you may want to examine your expensesand look for ways to trim them where possible. Doing so can set your business up for long-term financial health. This is one of many simple steps you can follow from the Universal Turnaround Model.

5. Increase Revenue

Take a look at your current product offering or service mix, and think of ways you can pivot to produce more revenue. Perhaps your customers can benefit from an add-on service to use your product in more situations. Or maybe there’s another customer base you can tap into with a different kind of product that costs less to produce than what you currently offer.

6. Consolidating Debt

As you begin working off your debt, consider consolidating all your various debts in one place. Consolidatingcan simplify your financial life significantly and make it easier to manage multiple payments.

7. Improve Your Financial Standing

To enhance your financial situation, form an LLC. Due to the tax benefits, you may owe less come tax season. Various states have different rules for forming an LLC, so check the details in your state before proceeding. If you don’t want to do the groundwork yourself, a formation service can save you money on lawyer fees.

Healthily Growing Your Business

Getting out of debt isn’t an easy process, but it can be done with time and effort — as long as you’re serious about your goals. Focus on getting paid, sticking to a budget, cutting expenses and finding ways to increase your revenue as part of your main goals, but don’t let mistakes and slip-ups derail you. Instead, use them as learning experiences, get back on track, and focus on what matters most — healthily growing your business.

Learn more how you can address cash flow concerns with “Red to Black – a turnaround guide for accounting professionals” when you work with business owners as their Profit & Growth Expert.