Get The Skills To Be A Tax Preparation Professional

Professional Tax Preparer™ Certification

Become proficient in the planning and preparation of both individual and business returns. As a certified Professional Tax Preparer™ you’ve been trained and tested to provide the quality services expected from a tax preparer. What better service to complement accounting than tax preparation and planning? By mastering this one skill you can increase your income by approximately $100+ per hour.

Why Professional Tax Preparer™ Certification?

Universal will price match any other schools pricing.*

Why so many enroll in the Professional Tax Preparer (PTP) program to improve their accounting career:

✓ The professional designation of “PTP” that certifies their skills preparing individual and business returns

✓ The ability to pay the tuition in full or take advantage of the available student loan options to finance

✓ The assigned individual coaches, an orientation counselor, academic coach (individual tutor), marketing coach

✓ The 100% money-back guarantee (see below)

✓ The ability to do the program in weeks rather than months

✓ The Continuing Professional Education, CPE, credits available – 67 hours. (Module1: 24 hours, M2: 18, M3: 20, M4: 5)

You also can have the many benefits of a lucrative business when you become a Professional Tax Preparer™, including:

✓ Earn $100+ an hour

✓ Work whenever and however you want

✓ Reduce your own tax liability

✓ Be in demand for your skills

✓ Work from home

✓ Work full-time or part-time

The Opportunity to offer tax services – individual returns and business tax filings

- Nearly 80% of Americans were required to file taxes this year.

- Approximately 144 million individuals and 2.4 million corporations filed returns last year

- 82 million returns are prepared by paid professionals, only 23% of which are handled by franchises

- 32,000 tax preparation firms generate approximately 7.7 billion in revenue

- The majority of the firms that prepare tax returns are small, with less than 10 employees

- The tax prep industry is expected to grow by 4% compounded annually

- Source – LibertyTaxBus

Changing legislation in the tax code and health care reform could require more people to file each year. Employers and clients look for respected credentials when choosing to trust a tax professional. “Accounting and finance professionals are in high demand, thanks to the steadily rebounding economy. Still, it’s the advanced certifications you earn that will help you secure the position and compensation you want. When you take the time to invest in professional development and certifications, it makes your resume stand out and sends a message to employers that you’re dedicated to your career and motivated to advance by enhancing your skills and knowledge.” by Robert Half Finance & Accounting (Below a page from the RHI Salary Guide) This was then updated to show:

Getting Certified

– Self-paced online personal & business tax training, to become proficient in business & individual tax planning & preparation

The training includes: (Click on each module for details & Table of Content)

- Establishing the Tax Foundation: Learn the entire process for determining income and adjustments to income, which will factor into the Adjusted Gross Income

- Becoming the 1040 Expert: Understand all the adjustments that can be made to adjusted gross income, including credits that are allowed and different types of deductions and exemptions that can be taken against that adjusted gross income number

- Profitable Business Returns: Experience completing each of the schedules and forms common to business organizations. See the various business types and why one may be chosen over another. Learn tax concepts in accounting, “Elements of Business Financial Statements,” and how to report gain and loss on dispositions of business property.

- You’ll have an assigned Academic Coach & Tutor for support

After completing the training, Universal Accounting students feel confident and fully prepared to take the Professional Tax Preparer™ certification exam. The Professional Tax Preparer™ program may also qualify for as many as 67 Continuing Professional Education (CPE) credits depending on the state or association you are a member of.

- Some states offer related services to help those offering tax services and may have additional requirements.

You’ll have access to the support of knowledgeable CPA’s and other experienced accounting professionals throughout your course and beyond. (You’ll be assigned to a team of coaches to tutor and instruct you as needed and apply all of this in the real world for as many as 1 to 2 years – Your UAC Coaches)

Your enrollment also includes the opportunity to become certified as a Professional Tax Preparer and use the (PTP) designation upon qualification.

- You’ll have an assigned Marketing Coach to support & help build a tax business

- Building Your Successful Tax Practice: The turnkey process to start & build a successful tax business. This includes proven marketing strategies, pricing, client interviewing for tax planning and preparation and much more.

- As part of your enrollment and upon completion of the program you’ll have the opportunity to speak with your assigned business coach and have a Marketing Implementation Session. This will be a one-on-one discussion to develop your business plan and a clear marketing strategy to get you the clients you need.

Bill came to the world of ledgers and tax returns by an unlikely route. He majored in music, and spent time as a songwriter in Los Angeles, even landing a spot on a production team for a Stevie Wonder spin-off called Writer’s Quarters West. To help make ends meet for his young family, Bill started a small business in 1988, part-time, while still keeping a foot in the music industry. But it quickly consumed all his time and energy, and he discovered that he actually enjoyed running a business, which required learning how to keep the books, which led to an MBA in finance and accounting. Eventually, Bill was hired by Universal Accounting Center in Salt Lake City to teach their unique bookkeeping and tax preparation courses to students from all over the country. He has been a lead writer and editor for Universal Accounting’s Professional Tax Preparer course. He also worked several seasons as a tax professional for H&R Block. Having worked several seasons as a tax professional for H&R Block, Bill currently runs his own thriving bookkeeping, accounting and tax preparation business.

Convenient At-Home Learning: How It Works

The Professional Tax Preparer™ Program course consists of 20 – 67 hours of training. Our tax preparation courses include the books and worksheets (over 600 pages of instruction and reference materials). This tax training course is very engaging and entertaining. You have the flexibility to complete the courses on your own time, in a way that fits your life. The course is taught by our experienced accounting professionals who give practical advice on not only tax issues, but also provide real-world solutions to give you the edge in productivity and profitability. Our tax instructors know what challenges you will face because they have been there themselves. (You’ll be assigned to a team of coaches to tutor and instruct you as needed and apply all of this in the real world for as many as 1 to 2 years – Your UAC Coaches)

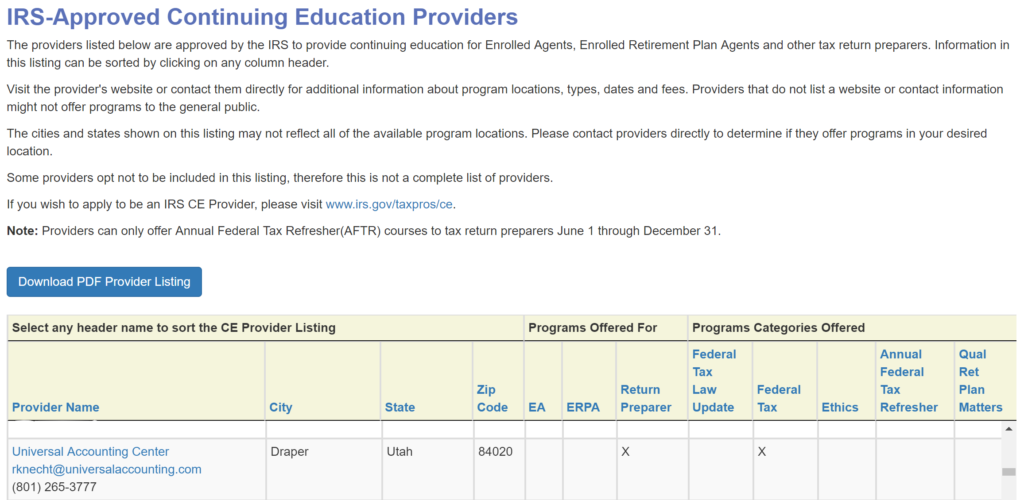

Universal Accounting®, the leader in small business tax training has been approved by the California Tax Education Council (CTEC) to offer the Professional Tax Preparer™ Certification (PTP) as a distance learning course in the state of California.. Universal’s recognition from CTEC authenticates the PTP course, showing it is within the “standards, guidelines and procedures” of instruction specific to California tax laws.

“I have reviewed the application for the course referenced above (Professional Tax Preparer, PTP, program) and recommend council approve this course as a Qualifying Education Distance and Interactive learning course. The material is not only impressive for its comprehensive coverage but is written in an easy to understand manner. The annotated curriculum guidelines were only complete but very easy to review and test check.” – Frank Cabrera, Curriculum Provider Standards Committee Chair – CTEC

The Universal Accounting®’s Professional Tax Preparer™ program has received approval from the state of Oregon as a qualified training program for individuals wishing to prepare income taxes. Universal Accounting® received approval from Oregon’s State Board of Tax Practitioners. Oregon is one of two states requiring state-approved tax courses for tax preparers.

If a lack of certification has held you back, you now have the way to quickly get your career off the ground and take control of your financial future. We will customize a program for you based on your career goals, experience level, and budget. Job Placement Assistance Program (PB, QS and PTP Programs) As a student and or graduate of Universal Accounting’s Professional Bookkeeper program a buyer may be assisted with:

- Resume Preparation – Assistance via email in the review and development of a resume for the purpose of securing interviews

- Resume Placement Assistance – Helping to identify possible employers and accounting related positions by following a weekly routine

- Interviewing Technique Review – Role play advice and suggestions to improve the success of interviewing opportunities.

Our Guarantee

We’re so confident in our programs and their ability to provide the instruction, hands-on application and on-going professional guidance it takes to help you succeed, we guarantee it. If, after completing the tax preparation course, you feel the course didn’t live up to your expectations, simply return the materials to Universal, for a 100% refund of any monies paid minus interest.